Friends, this year threw us a curveball.

What started as a $46,500 foundation and deck repair turned into a full-blown home renovation saga that skyrocketed to $102,705.12 — a 121% increase from our original estimate. 😵💫

Let’s talk about how we got here, what we learned, and how we’re attacking this mountain of debt — without paying a single dollar in interest.

The 3 Costly Change Orders That Blew Our Budget

What should’ve been a straightforward repair turned into three major change orders:

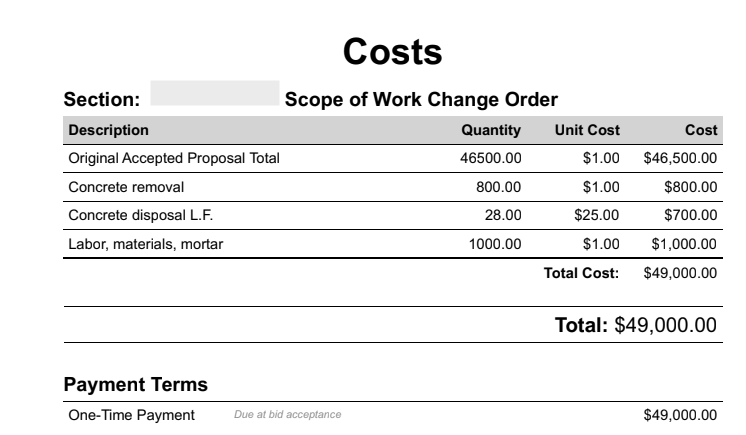

1. Surprise Concrete Removal – $2,500

Our structural engineer missed a slab of concrete under our deck. He thought it was a mound of dirt. It wasn’t. That mistake cost us $2,500 for removal and disposal.

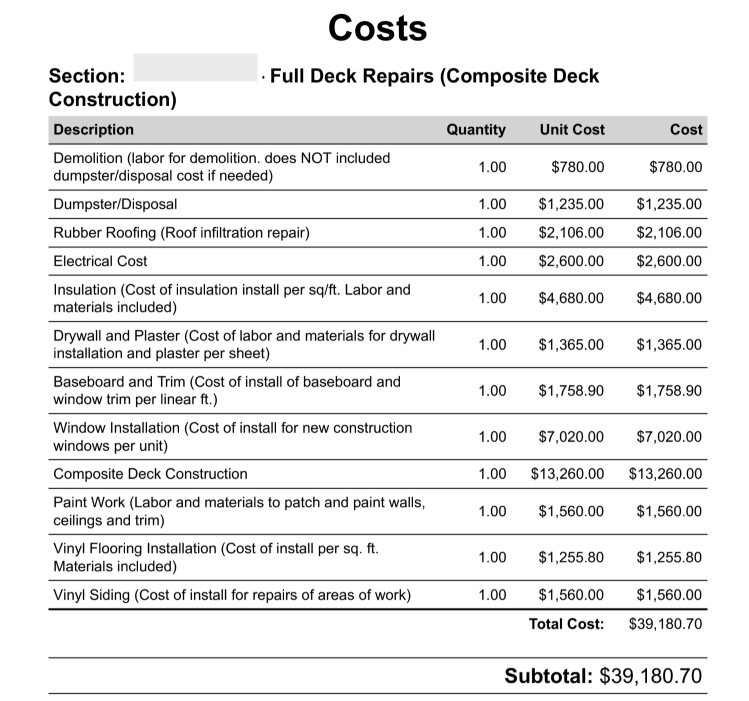

2. From Deck Repair to Full Rebuild – $8,075 ➡ $39,180.70

We initially budgeted to fix 19 frames of the deck. But once the crew opened it up, it was clear the entire structure needed to be rebuilt from scratch. Hello, nearly $40,000 change.

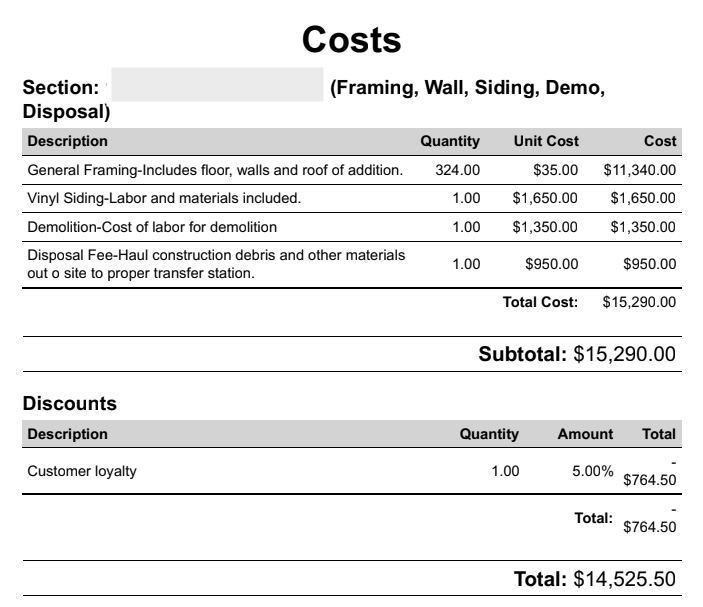

3. Rotten Roof Reveal – $14,525.05

Just when we thought we were done, we found out the roof of our deck was completely rotted. We had to tear it off and rebuild it, adding another $14,525.05 to our tab.

The Total Damage: From $46,500 to $102,705.12

The final tally? $102,705.12 — more than double our original plan. And with a looming 22.5% interest rate kicking in by year-end, I was staring down the beast of debt, completely overwhelmed.

I kept asking myself: Why now? How can we possibly get through this without going under?

3 Steps We Took to Manage Our $40K Surprise Debt

Here’s what we did — and are still doing — to get through it without a single late payment or dollar of interest.

1. Prioritize High-Interest Debt First

We made a list of every debt we had, their balances, and interest rates. Then we ranked them by urgency. The foundation and deck rebuild became our top priority.

Why? Because of the sky-high interest rate coming if we didn’t pay it off by the end of the year.

2. Cut Down “Wants” to Free Up Cash

We already had a solid budget and savings plan. But when my husband got laid off, I knew we had to adapt. So I revised our financial plan and slashed:

- Restaurants

- Entertainment

- Clothes shopping

- Travel

This gave us an extra $650–700/month to put toward debt.

3. Track Progress With a Visual Spreadsheet

I created a simple, color-coded spreadsheet to keep track of everything:

- Contractor charges

- Change orders

- Down payments

- Remaining balance

- Monthly payment progress

It’s like our battle map against debt — and it keeps us motivated!

Our Debt Payoff Plan: Month-by-Month Breakdown

We committed to paying $2,700/month, with a balloon payment of $8,729.99 in December. Here’s our current payoff schedule:

| Month | Payment |

| Jan | $2,745.84 |

| Feb | $2,745.84 |

| Mar | $2,745.84 |

| Apr | $2,745.84 |

| May | $2,745.84 |

| Jun | (Upcoming) |

| Jul–Nov | (Scheduled) |

| Dec | $8,729.99 |

Final Thoughts: From Panic to Progress

Yes, this project felt like a financial nightmare at first. But we’ve gained something priceless: clarity, teamwork, and a system to handle surprises.

If you’re facing a sudden home renovation cost or unexpected debt, know this: you’re not alone, and there’s always a way forward. It’s not about being perfect — it’s about being persistent and strategic.

Let me know if you want a copy of our debt tracker spreadsheet — happy to share the template!

Leave a comment